US | Treasury yields reflect the view that disinflation likely resumed in 2Q

Published on Thursday, June 27, 2024

US | Treasury yields reflect the view that disinflation likely resumed in 2Q

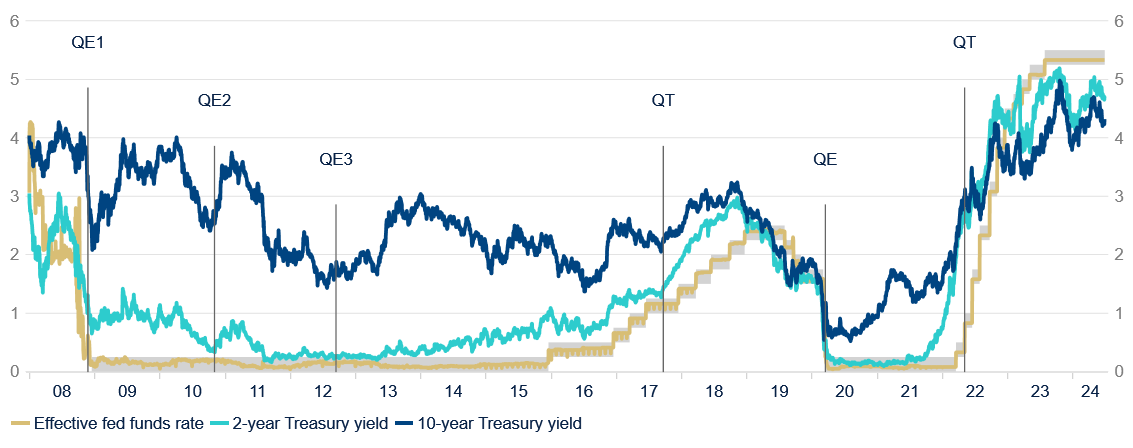

Mid- and long-term Treasury yields eased further from their late-April’s highs on a less hawkish than expected Fed in this month’s meeting, and fresh signs that the inflation jump in 1Q will prove transitory.

Key points

- Key points:

- “Conservative” inflation projections pointed to a slight improvement of confidence among FOMC participants, which partly explains why Treasury yields have kept declining.

- The modest deterioration of inflation expectations in 1Q reversed this month entirely, even as markets have come round to the view of a high-for-longer approach.

- More good inflation data could push the already well-anchored market-based inflation expectations even closer to 2%, opening the door to a reassessment of the policy rate path.

- This could lead markets to fully price in at least two rate cuts this year; even Powell noted that the Fed’s median forecast of a single cut before year end was a “very close call.”

- Mortgage rates have recently been less sensitive to the evolution of long-term Treasury yields; corporate bond spreads increased slightly, but they remain well below average.

Documents to download

FED FUNDS RATE AND TREASURY YIELDS

(%)

The gray area indicates the fed funds rate target range; QE and QT indicate quantitative easing and tightening announcements. Source: BBVA Research / Fed / Treasury

Authors

Geographies

- Geography Tags

- Global

Topics

- Topic Tags

- Central Banks

- Financial Markets