US | Treasury yields edge higher as disinflation hits another bump on the road

Published on Thursday, November 28, 2024

US | Treasury yields edge higher as disinflation hits another bump on the road

Summary

Part of the rise in Treasury yields is also explained by a higher term premium, which has likely been driven by greater uncertainty around the US inflation and fiscal outlook in the following years amid Trump’s potential trade, tax and migration policies.

Key points

- Key points:

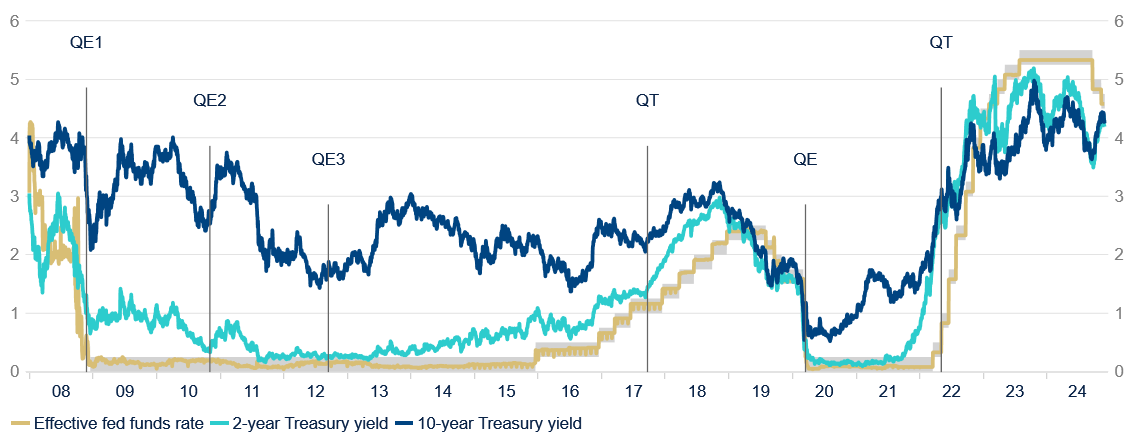

- Financial markets have priced in the risk that inflation could remain elevated for longer than previously expected, as shown by a roughly 80bp-shift in the yield curve.

- Market-based inflation expectations have increased, but Fed members are unlikely to be concerned: “many highlighted the importance of focusing on underlying trends.”

- Both inflation data and the uncertainty around the future of the US economy have driven the futures market to significantly reassess its policy rate expectations.

- Mortgage rates mirrored the increase in yields amid the housing sector’s supply-side issues, but the corporate bond market remains immune to the increased uncertainty.

- Increased perceived risks after Trump’s victory had less of an impact on professional forecasters’ interest rate predictions than on market-implied expectations.

FED FUNDS RATE AND TREASURY YIELDS

(%)

The gray area indicates the fed funds rate target range; QE and QT indicate quantitative easing and tightening announcements. Source: BBVA Research / Fed / Treasury

Geographies

- Geography Tags

- US

Topics

- Topic Tags

- Central Banks

- Financial Markets

Authors

Javier Amador

BBVA Research - Principal Economist

Iván Fernández

BBVA Research - Senior Economist